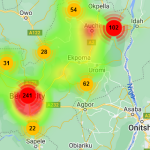

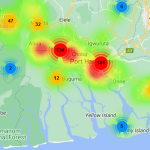

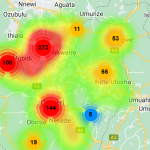

Demonstrations in the Niger Delta – October 25-31, 2020

October 30, 2020

[Policy Brief] Developing a Peace and Security Infrastructure in Abia State

November 4, 2020

By Chuks Ofulue

Policy Background

The Abia States economy is currently at a cross-road and has been for the past decades. The State has witnessed almost three decades of economic downturn and at best economic stagnation even at the time when Nigeria was growing at the rate of 7.5%. This growth did not see enough jobs or investments created with the economy failing to translate growth in output into lower unemployment and increased wealth creation. As growth accelerated, there was ample evidence to suggest that unemployment had increased. Outside oil and gas, tradeable sectors that pose huge potentials in the state have not been developed, leading to weak structural transformation and limited employment opportunities. Abia State’s economy has been largely consumption-based because of oil wealth but this has not increased productivity or urban/rural employment or reduce poverty as should be the case. Given the low employment capacity in the oil sector, economic diversification is important for economic growth, job creation, and poverty reduction.

Abia States’ informal small business sector which has been the engine of growth and diversification, continues to face a challenging business environment. In addition to continuing scant electricity supply, multiple taxation and illegal levies are one of the major impediments to doing business in the state (FIAS, 2008, DFID, 2008)[1]. The state comprises of 17 local governments. The exact number of taxes levied on businesses in the state seems to vary significantly between what is imposed by the Federal government, state, and local governments throughout the state. Businesses may be subject to as many as 100 different taxes, charges, fees, and levies and in some instances, tax for the same event or asset that are levied by the three tiers of government.

In an environment where trade taxes, surcharges, and a plethora of other levies add to the cost of operational and transaction costs of business, their arbitrary implementation heightens the uncertainty to business enterprises in Abia State and further increases the cost of doing business. The impact of multiple taxations and illegal levies on competitiveness, and therefore external integration can be profound. Anecdotal evidence suggests that the current system of taxation in the state is characterized by a high incidence of “nuisance taxes” (illegal levies) on the mobility of goods and people within the State and across state boundaries and the prevalence of double taxation. The direct burden of official taxation on businesses is also compounded by the administrative burden to comply with these taxes which is found to be significantly higher than competitors from either the northern or western parts of the country[2]. Studies found that;

- On average, businesses in Abia pay around 32% of the pre-tax profit on taxes[3]

- The presence of illegal levies is high. In the aggregate, businesses pay the overwhelming share of taxes to the Federal Government (about 87% of the tax burden), and only a small share of taxes are collected at the state, local and MDA levels in form of numerous small taxes that, at less than one percent of total tax revenues, are tantamount to “nuisance taxes”.

- Small traders are penalized, even more, sector analysis suggests that the agriculture sector comprises relatively small firms that pay a relatively higher incidence of pre-tax profit around 54% which is indicative of a regressive impact of taxes.

- Taxes on mobility are particularly high; traders with mobile factors (inputs and outputs) are subjected to road-related taxes and/or levies which impede their pre-tax profits

Overall, high taxation levels and accompanying illegal levies have significant implications for businesses; reducing incentives to expand production, leading to higher prices, and distorting factor incomes. As businesses take investment decisions based on long term returns on capital, the cost of multiple taxations and illegal levies reduce the size of capital stock and aggregate output in the economy and discourage investments in productivity-enhancing measures. This ultimately leads to lower returns to capital and lower job creation.

It is likely that multiple taxations, illegal levies and high administrative burden in the State are major factors in the poor performance of manufacturing and trading businesses, which has resulted in a high number of reported closures, prominent among this, is the Aba textile mill. The high prevalence of informal enterprises in the Abia State economy, in turn, discourages efficiency gains from the economies of scale that are required to compete domestically and internationally, lowering returns to human and physical capital.

Addressing the issues of multiple taxations, illegal levies, and reducing the burden would increase the expected return on small businesses and entrepreneurs, it would encourage capital accumulation, investments, and job creation. Consequently, reforming taxes and reducing the burden could lead to an expansion of scale and greater economic efficiency in the State.

From the government’s point of view, the evidence suggests that the three tiers of government are exploiting the existing tax base. Taxing a specific tax base will lead to increased revenue up to a specific point, after which the overall tax revenue will decline because businesses go out of business, or evasion increases significantly. This suggests that the government could likely generate higher tax revenue with lower compound tax rates. The low compliance level is likely due to the high compliance costs, limited transparency, as well as the incidence of multiple taxations.

Policy Points

In general, the current design and application of Nigeria’s federal and state tax system represents a significant impediment to formalize and grow a business, and compete in the national markets. The multiplicity of taxation, illegal levies, and the administrative burden created by the uncoordinated and lax enforcement mechanisms across different levels of jurisprudence has given rise to significant costs, particularly penalizing smaller and more remote businesses. The large amount and magnitude of taxes and levies relating to mobile factors, for instance, lead to the economic isolation of distant areas, prevents the establishment of supply chains, and reduces competition among businesses located in communities within the State and different States within the country.

Part of this long term plan is for Abia State to reconsider the development of tax policy in the State over the last decade or so and assess policy change against multiple taxations and illegal levies which are consistent and coherent to ensuring the ease of doing business in Abia and that the numerous small businesses are viable. The need for reform and a clear strategy for reform remains as pressing as ever. The following provides key policy points to consider;

- Eliminate illegal levies and align tax bases. To reduce the multiplicity problem and therefore the administrative costs they create. The State government should enter into a dialogue with other tiers of government to reduce the overall number of taxes without necessarily reducing the amount of tax revenue collected. Taxes could be regrouped at the local government level and levied consistently. This would increase transparency, provide greater legitimacy to taxes that businesses have to pay and prevent opportunities for collecting additional “taxes” by illegal tax collectors.

- Eliminate mobile levies. To ensure that Abia state is competitive for investors through improvements in the business climate or simplification in the tax systems. However, it will be critical that the state’s policy seeks to collaborate with the federal government to enforce a single economic space by abolishing all kinds of fees, levies on mobile factors, and removing roadblocks on internal traffic. Such a measure will likely meet substantial resistance from local governments and related lobby groups that are currently benefitting from these arrangements and close coordination with the State. This could help create strong support from civil society that could create a counterweight to vested interests of a limited number of beneficiaries that nevertheless seem to be very well connected politically.

- Improve transparency in the tax system. The policy should create a simple and well-understood tax system that will eliminate the chances of corruption and harassment by tax officials and consequently of non-compliance by taxpayers. A critical step will be to publicize taxpayers’ rights and responsibilities. Specifically, there is a need to provide adequate awareness to taxpayers on the list of approved taxes at the federal, state, and local government levels to check arbitrariness in assessment by properly defining the tax base, tax rate and other aspects of tax administration- and to establish an independent, yet powerful complaint body that taxpayers in the state could turn to when treated in violation of their rights.

- Aligning Abia State taxes to the Federal government tax base. The problems of coherent non-alignment among the different tiers of government have lingered on also because all the tiers of government have failed to adequately fund their department and agencies. This development has compelled them to embark on aggressive revenue drive some of which verge on illegality in the name of increasing their Internally Generated Revenue. For policy considerations, the following specific steps are recommended for Abia State to seriously consider in order to curb the problem of multiplicity of taxes and levies: (i) make available to the local governments all the revenue from the Federation Account, (ii) allocate 10% of State revenue to the local government councils, (iii) adequately fund the various agencies and departments and (iv) ensure that the Ministry of Local Government and the House of Assembly play their oversight functions very well on the activities of the local government.

These reforms would increase economic efficiency and reduce inequalities in the tax burden between small and large enterprises. They would also make enforcement of legal taxes simpler. Eliminating double taxation of specific tax bases, reducing the total number of taxes paid, increasing transparency as to how and what to pay will help to streamline and simplify the tax system and reduce the regressive nature of the State’s current tax system that puts an additional burden on smallholder farmer, agricultural companies, small companies and businesses in remote areas of Abia State. Policy reform would directly benefit those small businesses enterprises that are the potential engine of growth and are likely to create the largest number of jobs.

[1] Multiple taxation is often referred to when same asset or event is taxed multiple times by different jurisdiction in a federal system. We extend the definition to include illegal levies as they can exacerbate the burden of administrative cost of government and businesses.

[2] The FIAS (2008), DFID (2008) and CIPE (2010) studies on taxation in Nigeria primarily focused on its direct burden.

[3] World Bank’s doing business survey (2011) revealed that Nigerian small businesses on the average paid around 32 percent in pretax on profits compared to 41 percent in Ghana, 49% percent in Kenya and 31 percent in Rwanda.

_________________

Chuks Ofulue manages PIND Foundation’s Advocacy program